The Super Plus advantage

Not every SMSF is the same, each is unique to the style of the trustees. So why use a service that doesn’t provide the full flexibility and services your SMSF could need. You have a SMSF for flexibility, choice and control!

We are a full service SMSF provider, which means we don’t deliver half a service. We promise and deliver the full range of SMSF services, for both your current and your future requirements.

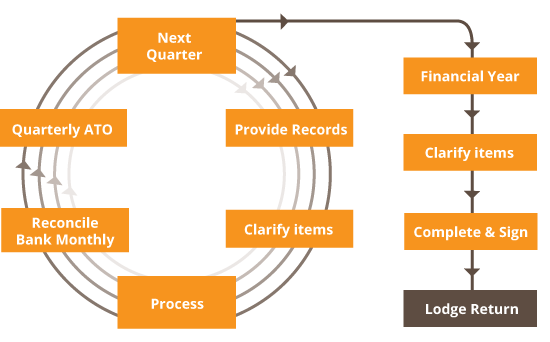

The continuous accounting cycle

We operate on an ongoing continuous accounting cycle, not an annual or “once a year” basis.

Therefore, we process transactions and review compliance matters for your SMSF continuously throughout the year. This offers huge benefits over processing your fund once a year.

| Continuous Accounting Advantages | |

|---|---|

| Always up to date | Issues identified early (minimises compliance issues) |

| Regular reporting | Planning based on up to date information |

| More effective decisions | Better cash flow management |

| Realised gains/losses reports current and up to date | Regular income per investment analysis is possible |

| Accurate quarterly tax calculation and payment | |

Compare the alternative, Super Plus services vs ‘once a year’ or ‘adhoc’ provider;

| Structure | Super Plus | Annual Provider (normal accountant service) |

|---|---|---|

| Direct Shares |  |

|

| Retail Managed Funds |  |

|

| Wholesale Managed Funds |  |

|

| Direct Property |  |

|

| Non-Standard Investments |  |

? |

| Limited Recourse Borrowing (Security trust structure) |  |

? |

| Complying Pensions – Grandfathered |  |

? |

| Pensions – Account Based & Transition to Retirement |  |

/ ? / ? |

| Reserve Accounts |  |

? |

| QROPS Registration & Operation (for UK Pension transfers) |  |

? |

| Accumulation & Pension in same fund |  |

/ ? / ? |

| Fixed Fee |  |

? |

| Fund Establishment | ||

| Trust Deeds & Minutes |  |

/ ? / ? |

| ABN, TFN, GST Registrations (GST-if required) |  |

/ ? / ? |

| Turnaround time of new orders – 5 days |  |

? |

| Corporate (Company) Establishments |  |

/ ? / ? |

| Trust Deeds | ||

| Standard Deed or Deed of your choice |  |

? |

| Change between individuals and Corporate Trustee |  |

? |

| Deed of Appointment / Resignation |  |

? |

| Deed Upgrades |  |

? |

| Lost Deed Replacements |  |

? |

| Pensions | ||

| Pensions Commencement – At anytime during the year |  |

? |

| Pension Calculations |  |

/ ? / ? |

| Annual Pension Adjustment |  |

? |

| Centrelink Schedules |  |

? |

| Actuarial Certificates |  |

/ ? / ? |

| Reporting | ||

| Financial Reports Preperation |  |

|

| Tax Return Preperation & Lodgement |  |

|

| Adhoc Reporting |  |

? |

| Quarterly Reports |  |

? |

| Online Reports |  |

? |

| Member Reports at any time |  |

? |

| House Keeping | ||

| Sample Investment Strategy |  |

? |

| Mailing Address |  |

? |

| IAS / PAYG / BAS Returns |  |

/ ? / ? |

| Monthly Bank Account Reconciliations |  |

? |

| Direct Tax Payments |  |

? |

| Independent Audit |  |

/ ? / ? |